Posted on Mar 25, 2014

$HOW ME THE MONEY!!! In fact, show me lots. The more the merrier.

Money comes in pretty handy when you’re trying to run a small business, you can’t keep the doors open and the lights on without it.

So, what’s the biggest source of cash available to your business?

Let’s take a look.

There are a few different ways cash can flow into your business. Via a bank loan (that’s no fun, it costs to borrow), an investment out of your own pocket (even less fun), from the sale of an asset (great, if you can find a buyer)

or

VIA PAYMENTS FROM YOUR CUSTOMERS!!!

When was the last time you really looked at how much your customers owe you?

The Customer Reports section in your accounting software will have an option for a report that is one of the most useful tools available to your business. It’s called an Aged Trial Balance (ATB) or simply an aging. If you’re not sure ask your bookkeeper, they can tell you! This report is a schedule listing the names of your customers along with the amounts they owe you; this is known as Accounts Receivable.

You can get a detailed or summary version of this report. The summary version will list customer names and balances owing; the detailed report will also include invoice numbers. The detailed report is the one we suggest you use for collecting money.

The balances listed on the aged trial balance will be split into different aging categories; you can use this information to measure how good (or horrible) you are at collecting money.

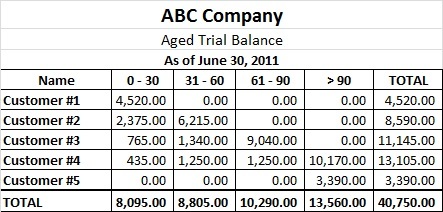

Here’s an example of a typical summary report:

Amounts listed on the aged trial balance (ATB) are split into different aging buckets based on how long an invoice has been outstanding. To keep things simple, the breakdown of the various aging buckets should be the same as your credit terms (the period of time between when you deliver your goods and/or services to when you expect payment). So, if you want your customers to pay you 30 days from the date of invoice, your aging categories should be broken down into 30 day increments like the example above.

The collections department uses the ATB to place calls to customers with past due balances owing. Many people will work through this list alphabetically, my favourite strategy was to call the customers with the highest and oldest amounts owing first. That way, if the customer didn’t cough up the cash, I had time to call a second time before month end.

Keeping detailed notes of what your customers tell you during a collection call is important (cheques in the mail, signing officer will be in later in the week, expecting a big cheque on Tuesday, AP department not in). Record the date of your call, who you talked to, and what they said about paying their bill. These notes will be helpful if you need to place a follow up call a week or two later.

In the example above, Customer #4 should be called first, followed by, Customer #5, Customer #3, and Customer #2. Because Customer #1 is still in the current aging category a collection call wouldn’t be necessary as their amount is not yet past due (calling too soon could tick them off).

Did you notice that Customer #5 has stopped buying? There could be a few different explanations for this. They could be experiencing cash flow problems (not good), they could be bankrupt (even worse), or they could be refusing to pay due to a dispute with the order (time to roll up your sleeves and solve the problem), either way, once a customer stops using their account; the odds of collecting the balance owing decreases as time goes by.

Now, let’s take a look at the aging buckets. Wouldn’t it be nice to have the last two columns in your bank account?

Do you think ABC Company’s customers pay their bills on time? Nope, I don’t either! This could be because they haven’t received regular collection calls or because ABC Company has extended credit to customers who are a lousy credit risk. A regular review of the past due balances owing is key to learning which customers are always starring in your past due aging buckets. When you are able to identify any such customers, you need to decide whether you should temporarily or permanently suspend their open account privileges.

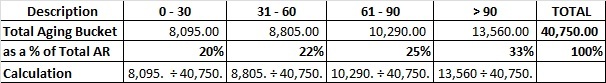

Another useful exercise involving the aging buckets is to calculate the totals of the different categories as a percentage of the total amount owing.

ABC’s numbers at June 30th show the following:

While a total of 58% (25% + 33%) seriously past due looks pretty bad (and it is) you really don’t have a true picture. Without access to the percentages from the end of May you don’t know if these percentages are actually an improvement. This is why going through this exercise each month is necessary; it allows you to track the progress of your collections. By comparing these totals on a monthly basis you can see if the past due percentages are better or worse than prior periods.

Closely monitoring your primary source of cash = healthy cash flow.

Healthy cash flow = HappyBoss

Karen