Posted on Mar 25, 2014

Financial Statements Made Simple

Income Statements 101

Part 3 of 3

This last section of an income statement answers the question every small business owner asks every month….DID I MAKE ANY MONEY?

Before we get to that, we need to get into a bit more background. We’ll start by taking a look at Operating Expenses.

These are the expenses that support the operation of your business; these amounts can be fixed or variable.

Hmmm….fixed or variable????

Fixed simply means the amounts don’t change from month to month, think rent or insurance.

Variable expenses are the opposite, so, the amounts do change from month to month. Examples of these types of expenses would be credit card fees or fuel.

Why does this matter?

It matters because fixed costs are going to be there month, after month, after month, it doesn’t matter if your sales are a mega bucks or no bucks. Ya still gotta pay the rent.

Variable expenses, on the other hand, tend to fluctuate with sales. As an example, think about how many more dollars a retailer would pay out in credit card processing fees in the month of December vs. the month of January. Sales go up….variable expenses tend to go up too.

Knowing what your variable and fixed costs are will help you arrive at proper pricing for your goods or services, and is especially important when it comes to the budget process (don’t worry, we’ll save that for another day).

FYI – Operating Expenses aren’t listed on your income statement under categories titled fixed or variable, instead, they are often listed under categories titled Selling and General and Administrative (G&A).

Selling expenses are directly related to selling your product or service, things like advertising or sales wages would fall into this category.

G&A type expenses relate to administration, so think of items like office supplies or office wages for this area.

Once the operating expenses have been totalled they are deducted from the Gross Profit amount (to refresh your memory….Gross Profit = Sales – Cost of Goods Sold). The balance left is referred to as Income from Operations.

Think of this as the money you have left after running the day-to-day activities.

Have you heard the big fancy business term EBIT?

EBIT stands for earnings before interest and taxes.

Guess what?

EBIT and Income from Operations are the same thing!

Not so fancy now is it?!!

OK….so….let’s decode another big business term.

EBITDA

Pronounce it as EBIT-DUH.

EBITDA stands for earnings before interest, taxes, depreciation and amortization.

So….this is simply the EBIT calculation with depreciation and amortization removed from the operating expense total. These amounts are still recorded; it’s just further down the report.

Whoop-dee-doo huh?

OK….so, up to now, we’ve only dealt with amounts that relate to regular business activities. What about amounts that don’t relate to your normal course of business?

We all have to pay taxes right?

That’s where the last section comes in….

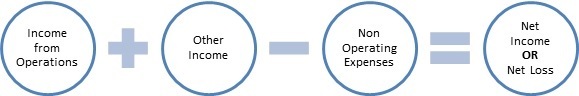

Any income earned outside of your primary business activity should be recorded in a separate account called Other Income. Amounts like interest income or income earned on the sale of an asset are examples of this type of revenue. This type of income can be taxed differently, so that’s another reason why it should be recorded on its own.

Non-operating expenses come next. These are amounts that are typically out of your control, things like income tax, foreign exchange and interest expense for example.

Once your non-operating revenues and expenses have been totalled they are added (if you have more income than expense) or subtracted (you have more expense than income) from the Operating Income total. The balance left is your Net Income or Net Loss.

And that’s the bottom line!

So….how DID your small business do last month?

A Profitable Boss = A HappyBoss

Karen